The Power of ORTEX Stock Scores in Maximizing Investment Returns

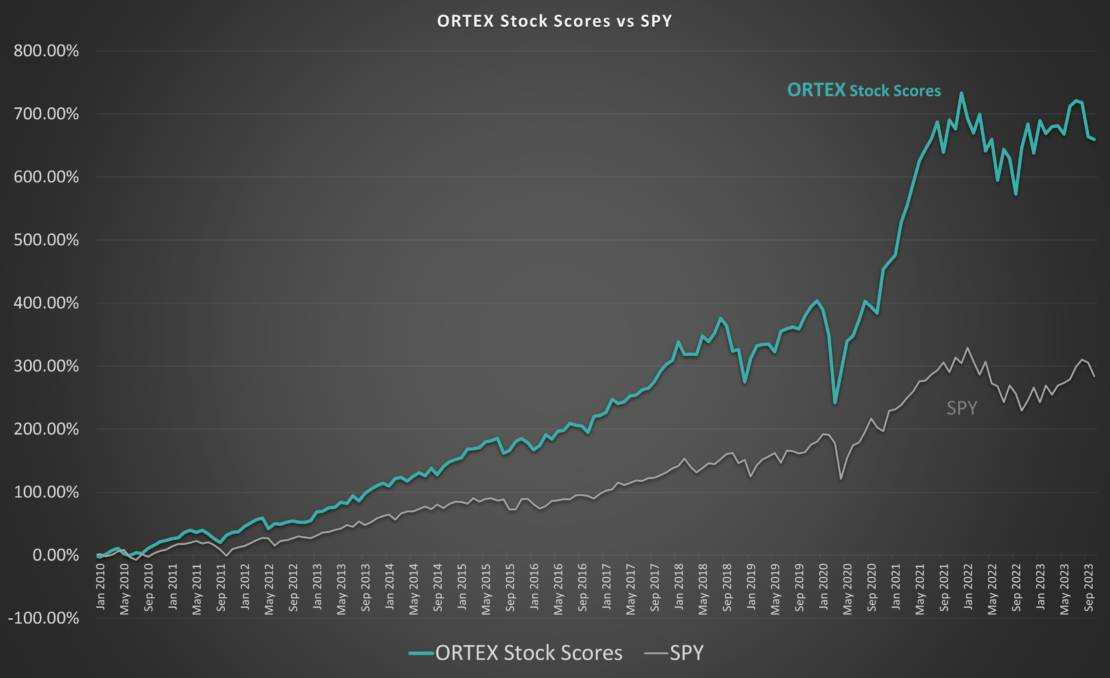

Imagine the potential of your investment portfolio if, starting from January 1, 2010, you consistently held the top 50 stocks as ranked by the ORTEX Stock Scores. This approach, as illustrated by our example, demonstrates the remarkable advantage of informed stock selection based on comprehensive data analysis.

In this scenario, where the basket of stocks is reevaluated on the first trading day of every month, the results speak volumes about the efficacy of the ORTEX Stock Scores. By adapting to the ever-changing market landscape and consistently choosing the highest-ranked stocks, this method has achieved a phenomenal 659.59% return. In comparison, a standard investment in the S&P 500 Index (SPY) yielded a return of 283.93% over the same period. The disparity in performance highlights the significant edge provided by leveraging the ORTEX Stock Scores.

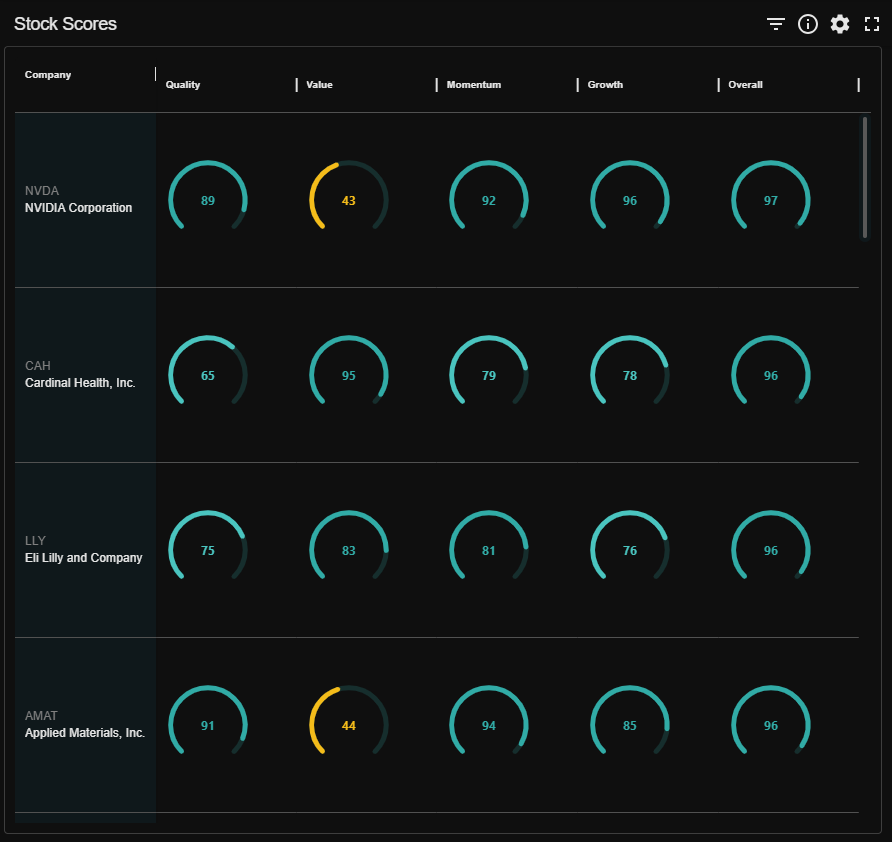

ORTEX stock scores are not just ordinary metrics; they represent a synthesis of various financial indicators, market trends, and advanced predictive analytics. This unique amalgamation of data points offers a nuanced perspective on each stock’s potential, enabling investors to make more informed decisions.

The approach of holding the top 50 stocks based on ORTEX scores and monthly reassessment ensures that your portfolio remains aligned with the most promising market opportunities. This strategy not only navigates through market volatilities but also capitalizes on growth prospects, as indicated by the ORTEX scores.

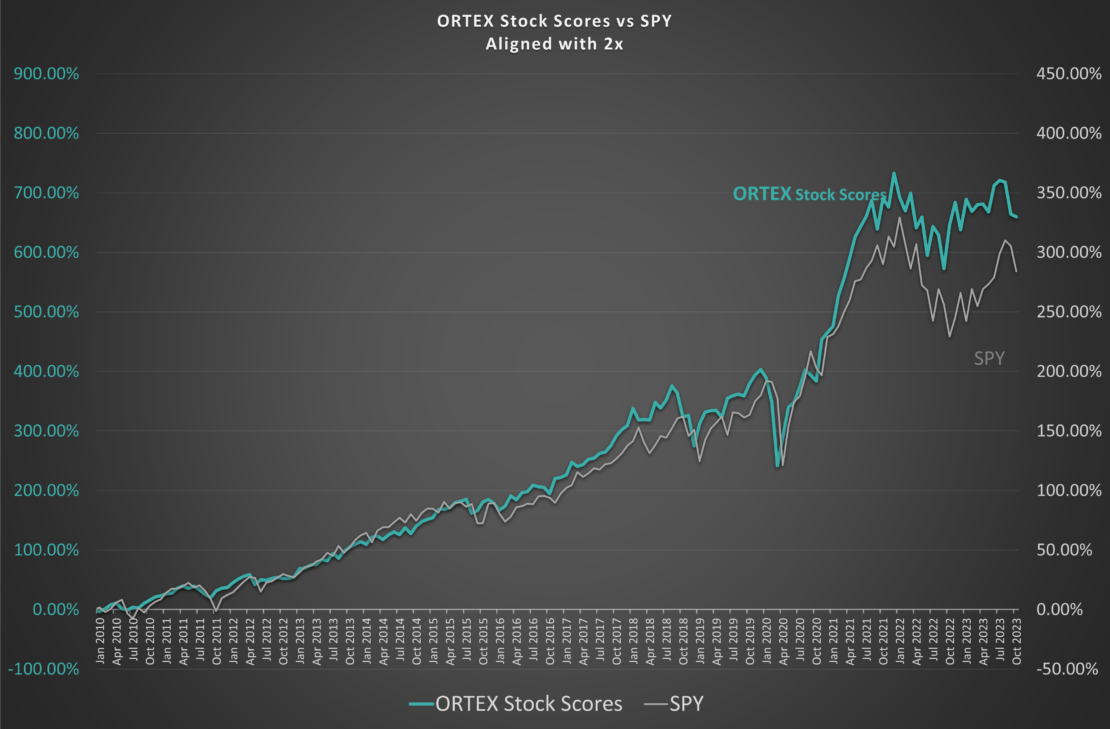

To highlight that the volatility is very similar between a SPY investment and one based on ORTEX Stock Scores top 50, below is a chart where SPY is on an axis that increases with half the speed.

Consider the implications of this methodology: over a decade of data shows that focusing on stocks with consistently high ORTEX Stock Scores yields superior returns. This pattern is a testament to the ability of ORTEX Stock Scores to identify stocks that are likely to outperform in the long term.

In the complex and often unpredictable world of stock investing, the ORTEX Stock Scores stand as a tool of clarity and insight. They transform the daunting task of stock selection into a more strategic and rewarding experience.

To conclude, this example illustrates that if you had held the top 50 stocks based on the ORTEX Stock Scores from January 1, 2010, and reevaluated your choices monthly, your investment journey would have been significantly more profitable than a conventional investment in the S&P 500. This strategy exemplifies the transformative power of data-driven investment choices and underscores the value of the ORTEX Stock Scores in achieving outstanding investment success.