ORTEX Monthly Recap for January

ORTEX Perspectives on the S&P 500 for January

The stock market kept its winning streak alive as all the major averages closed out January on a positive note, with each of the major indexes up more than 1% for the month. The S&P 500 closed at an all-time high for five straight sessions in January, buoyed by optimism on strong economic data and hopes of lower interest rates, as well as bets on artificial intelligence. January’s gains come despite a dismal final trading day of the month, after the Federal Reserve held steady on rates but Fed Chair Jerome Powell in his post-meeting conference discouraged investor hopes for a rate cut as soon as March, sending equities tumbling. In fact, on January 31, the Dow Jones Industrial Average fell 317 points, or 0.8%, posting its worst day since December. The S&P 500 slid 1.6% in its worst day since September. The Nasdaq Composite lost 2.2%, its worst session since October. Even with this stumbling block, January was still a solid month for stocks.

ORTEX Short Interest Data showed that the majority of sectors saw a decrease in bearish bets in January. Short interest (SI) shares in the Health Care sector rose the most, up 4.4%, while Real Estate stocks began 2024 with the largest decrease, down by 11.7% in January.

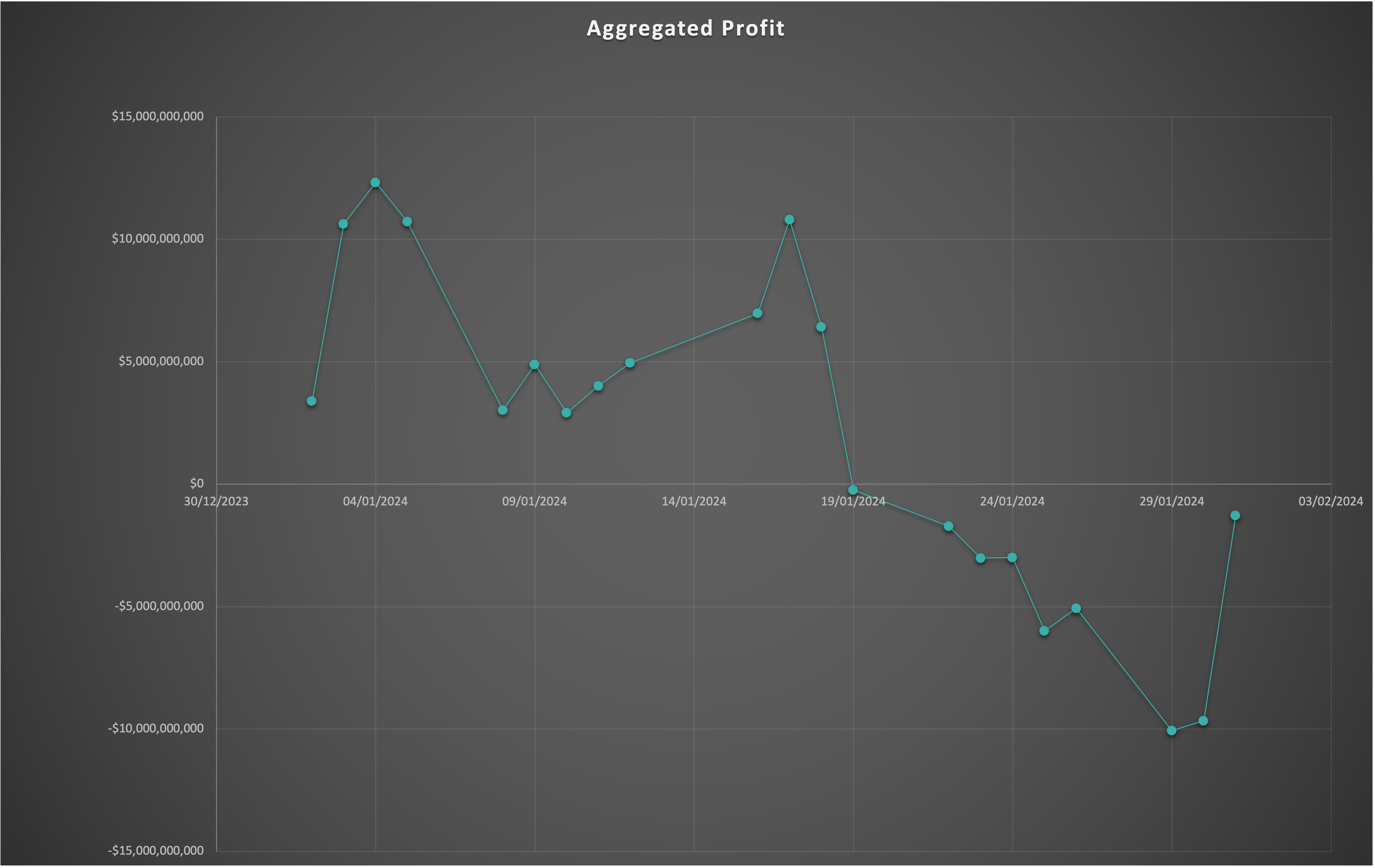

For the third month in a row, short sellers recorded losses as stocks closed out a turbulent January in the green. In the aggregate, the bears lost nearly $1.3 to kick start 2024.

Fourth quarter earnings season kicked into overdrive towards the end of January, with 176 companies, or 35% of the S&P 500, posting results already. As such, there have been some significant changes in forward-looking earnings estimates from Wall Street in January. In a complete reversal from December, Information Technology stocks saw the largest decrease in EPS estimates from analysts, down 10.05%. EPS estimates for the Financials sector fared the best, rising 7.73%.

Total Insider activity fell in January, down from $9.12 billion in December to $4.06 billion in January, of which 14%, or $575million, was Insider buying activity, according to ORTEX Insiders Data. Moreover, almost none of the total buying activity was ranked as Medium or High trade significance, meaning the activity was not based on conscious decisions and regular market transactions, rather it was the result of exercise of share options.

Market developments in January

The S&P 500 got back at record levels for the first time in two years during January. Information technology is the only one of the index’s 11 sectors that can say the same. Home to the likes of Microsoft, Apple and Nvidia, the tech sector is riding the mania over artificial intelligence and has propelled the broader market to a record close in five straight trading sessions. The tech segment was up around 6% to start 2024, whilst the 10 other segments were trading on average around 15% below their all-time highs and none set a new record in january. However, it wasn’t all plain sailing. These tech stocks, which played a leading role in propelling the S&P 500 to a record high in January, fell towards the end of the month. Meta, Amazon, Microsoft and Alphabet notched their biggest daily drops since late October, while Apple and Nvidia fell the most since January 2. Alphabet shares slid 7.5% the day after Google’s parent reported disappointing ad sales and projected an increase in capital spending to boost its artificial intelligence capabilities. Microsoft also forecast rising costs to develop AI features, but its quarterly results beat analyst expectations. Its shares were last off 2.7%.

The key macroeconomic event in January was the Federal Reserve interest rate decision on January 31. As expected, the Federal Open Markets Committee (FOMC) left its key policy rate unchanged at 5.25%-5.50% against a backdrop of gradually cooling inflation and a resilient economy.

In its statement, the FOMC said it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” effectively ruling out a March rate cut and disappointing investors who had hoped for a quick dovish pivot. Among the central bank’s concerns is an upward revision to inflation figures. The revised figures for the consumer price index — a closely watched price gauge — set to be released in February could reverse some of the recent improvement from late 2023.

Earnings season kicked off in January. Of the 176 companies in the S&P 500 that have reported earnings to date for 23Q4, 80.1% reported above analyst expectations. This compares to a long-term average of 66%. The 23Q4 year over year blended revenue growth estimate is 3.1%. If the energy sector is excluded, the growth rate for the index is 4.3%.

Highest Short Seller Gain and Loss for January

Once again returning to the top spot as the biggest loser for short sellers in January is Nvidia (Nasdaq:NVDA), as bears lost over $3 billion in the stock in December. The leading maker of artificial intelligence chips rose almost 25% in January as the AI craze drove the share price up. Nvidia got a huge vote of confidence last month when Meta CEO Mark Zuckerberg announced that the company is spending billions of dollars to acquire thousands of Nvidia chips for its AI projects. In an Instagram Reels post, Zuckerberg said Meta will build out AI infrastructure complete with 350,000 Nvidia H100 chips by the end of 2024 with the goal of developing general artificial intelligence. Moreover, Nvidia disclosed at CES new GeForce graphic processors for AI-enabled laptops and PCs. It also said electric vehicles are using its automated driving system. Li Auto and other EV makers have selected Nvidia Drive Thor for their fleets. ORTEX data shows short interest has stayed relatively flat at 1.15% of free float. The value of these short interest positions is $16.78 billion.

December was another losing month for short sellers, but Tesla (Nasdaq:TSLA) kicked the trend and provided a huge win for shorts. Tesla shares saw their biggest daily drop in over a year in January as the stock slid 12% a day after the company reported earnings that missed expectations and warned of a slowdown in 2024. Indeed, short sellers made more than $2 billion in one day on this price slump. The biggest concern was Tesla’s outlook. The electric carmaker said vehicle volume growth in 2024 “may be notably lower” than the rate observed last year, as the company works toward launching its “next-generation vehicle” in Texas. The company cautioned investors that it’s “currently between two major growth waves.” Short sellers made a staggering $5.2 billion in Tesla in January.

Please note that ORTEX Trading Signals are based on historical performance and are not investment advice.

Short Squeeze Candidates with the Highest ORTEX Short Scores

For the third month running, Sirius XM Holdings has the highest ORTEX short score on our platform (with at least 3 analysts covering the stock), coming in at 99.12 out of 100. Our ORTEX Short Score uses a multi-factor model that incorporates multiple short-related metrics, with a higher score indicating that the stock is heavily-shorted and has other characteristics that increase the possibility of a short squeeze occurring.

| Stock | Market cap USD | Sub-Industry | Short Score | Estimated Short Interest % FF |

| Sirius XM Holdings Inc. | $ 19,552,646,463 | Media | 99.12 | 27.3 |

| Danimer Scientific | $ 65,098,500 | Chemicals | 96.12 | 26.05 |

| The Lion Electric Company | $ 399,194,465 | Machinery | 95.25 | 13.91 |

| Beyond Meat | $ 427,260,797 | Food Products | 95.12 | 39.57 |

| Luminar Technologies | $ 1,116,743,026 | Automobile Components | 95.03 | 30.36 |

| Lexicon Pharmaceuticals | $ 456,326,179 | Biotechnology | 93.49 | 26.04 |

| PureCycle Technologies | $ 643,112,499 | Chemicals | 93.04 | 42.46 |

| MicroVision | $ 452,166,068 | Electronic Equipment, Instruments and Components | 92.98 | 26.22 |

| Sientra | $ 7,772,512 | Health Care Equipment and Supplies | 92.94 | 11.75 |

| Polestar Automotive Holding UK | $ 4,579,089,586 | Automobiles | 92.86 | 10.63 |

Download the ORTEX App!

ORTEX is now available as an app! Users can download the brand new ORTEX app from the Apple store or Google Play store.