ORTEX Monthly Recap for December

ORTEX Perspectives on the S&P 500 for December

The stock market finished 2023 with a bang as the S&P 500 climbed for nine weeks in a row to end the year, notching its best win streak since 2004. Risk assets enjoyed a big relief rally as the economy remained resilient and inflation cooled, while the Federal Reserve signaled an end to rate hikes. The market also endured a regional banking crisis as well as wars in Ukraine and the Middle East. Technology shares, especially mega-cap stocks, led the 2023 advance with Apple soaring 48%, Microsoft surging nearly 57% and Nvidia skyrocketing 239%. The tech-heavy Nasdaq Composite ended the year up 43.4% for its best year since 2020. The blue-chip Dow Jones Industrial Average logged a 13.7% gain and notched a new record during 2023. ORTEX Short Interest Data showed a more even split between bearish bets across the different sectors in December. Short interest (SI) shares in the Energy sector rose significantly and by far the most, up 21%, while Communication Services stocks closed out 2023 with the largest decrease, down by 7.5% in December.

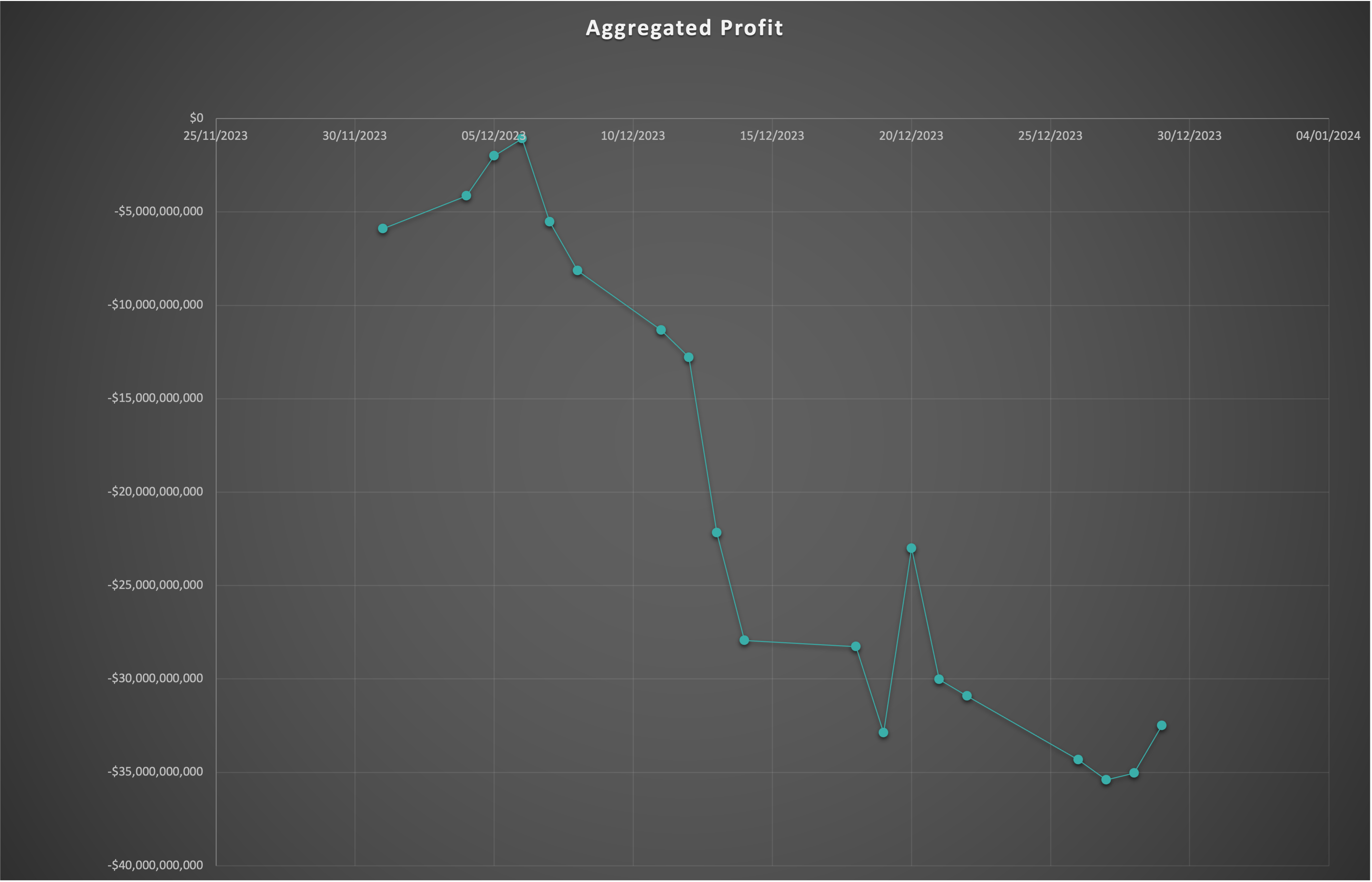

For the second month running, short sellers recorded losses as stocks closed out 2023 strong. In the aggregate, the bears lost $32.5 billion in December.

Following the end of the third quarter earnings season, there have been minimal changes in forward-looking earnings estimates from Wall Street in December. Information Technology stocks saw the largest increase in EPS estimates from analysts, up 2.40%. EPS estimates for the Energy sector fared the worst, down 2.17%.

Total Insider activity jumped for the second month in a row in December, with total activity rising to $9.12 billion, of which 26%, or $2.4 billion, was Insider buying activity, according to ORTEX Insiders Data. Interestingly, a large percentage of the total positive insider momentum of the S&P 500 is from one stock, Occidental Petroleum Corporation (NYSE:OXY). Warren Buffett-led Berkshire Hathaway (NYSE:BRK.A) acquired 5.2 million shares of OXY, bringing its stake in the oil company closer to 28%, according to regulatory filings. Berkshire purchased the shares between Dec. 19 and Dec. 21 for about $312.1 million. The week before, Berkshire Hathaway acquired nearly 10.5 million shares of Occidental for about $588.7 mln after the company agreed to buy U.S. shale oil producer CrownRock in a $12 billion deal.

Market developments in December

Tech stocks rebounded from a disastrous 2022 and lifted the Nasdaq to one of its strongest years in the past two decades. After last year’s 33% plunge, the tech-heavy Nasdaq finished 2023 up 43%, its best year since 2020, which was narrowly higher. The gain was also just shy of the index’s performance in 2009. Those are the only two years with bigger gains dating back to 2003, when stocks were coming out of the dot-com crash. The Nasdaq is now just 6.5% below its record high it reached in November 2021. Across the industry, the big story this year was a return to risk, driven by the Federal Reserve halting its interest rate hikes and a more stable outlook on inflation. Companies also benefited from the cost-cutting measures they put in place starting late last year to focus on efficiency and bolstering profit margins.

While the tech industry got a big boost from the macro environment and the prospect of lower borrowing costs, the emergence of generative artificial intelligence drove excitement in the sector and pushed companies to invest in what’s viewed as the next big thing. Nvidia (Nasdaq:NVDA) was the big winner in the AI rush. The chipmaker’s stock price soared 239% in 2023, as large cloud vendors and heavily funded startups snapped up the company’s graphics processing units (GPUs), which are needed to train and run advanced AI models. In the first three quarters of 2023, Nvidia generated $17.5 billion in net income, up more than sixfold from the prior year. Revenue in the latest quarter tripled.

After Nvidia, the biggest stock pop among mega-cap tech companies was in shares of Meta (Nasdaq:META), which jumped almost 200%. Nvidia and Meta were by far the two top performers in the S&P 500. Meta’s rally was sparked in February, when CEO Mark Zuckerberg, who founded the company in 2004, said 2023 would be the company’s “year of efficiency” after the stock plummeted 64% in 2022 due largely to three straight quarters of declining revenue. The company cut more than 20,000 jobs, proving to Wall Street it was serious about streamlining its expenses. Then growth returned as Facebook picked up market share in digital advertising. For the third quarter, Meta recorded expansion of 23%, its sharpest increase in two years.

Highest Short Seller Gain and Loss for December

Taking the top spot as the biggest loser for short sellers in December is Advanced Micro Devices (Nasdaq:AMD), as bears lost $1.18 billion in the stock in December. On December 6, AMD launched its Instinct MI300 accelerators and processors for data centers. Those systems for high-performance computing and AI applications will compete with Nvidia’s H100 series devices. AMD also introduced its latest mobile PC processors, the Ryzen 8040 series. The chips are designed for a new class of personal computers called AI PCs coming in 2024. These launches are only expected to help AMD continue taking market share from its competitors, buoying the share price. AMD also estimated the potential market for its data center AI chips could reach $45 billion this year, sending the share price higher. A number of analysts gave positive reinforcement for the stock in December, including Goldman Sachs analyst Toshiya Hari, who maintained a Buy rating and raised the price target from $137 to $157. ORTEX data shows short interest now stands at $7.7 billion, up nearly 57% from last month.

December marked another tough month for short sellers, but Exxon Mobil Corporation (NYSE:XOM) provided some relief. Since announcing its Q3 earnings late October, the stock has been on a slide. In Q3, Exxon’s net income fell by more than half to $9.07 billion, or $2.25 per share, from $19.66 billion, or $4.68 per share, in the year-earlier quarter, while revenues fell 19% year-over-year to $90.76 billion – driven by a nearly 60% decrease in natural gas realizations and a 14% decrease in crude realizations. Short sellers made $185 million in XOM in December.

Please note that ORTEX Trading Signals are based on historical performance and are not investment advice.

Short Squeeze Candidates with the Highest ORTEX Short Scores

For the second month running, Sirius XM Holdings has the highest ORTEX short score on our platform (with at least 3 analysts covering the stock), coming in at 99.24 out of 100. Our ORTEX Short Score uses a multi-factor model that incorporates multiple short-related metrics, with a higher score indicating that the stock is heavily-shorted and has other characteristics that increase the possibility of a short squeeze occurring.

| Stock | Market cap USD | Sub-Industry | Short Score | Estimated Short Interest % FF |

| Sirius XM Holdings Inc. | $ 21,012,372,525 | Media | 99.24 | 27.96 |

| MicroVision | $ 505,362,076 | Electronic Equipment, Instruments and Components | 96.77 | 25.61 |

| The Lion Electric Company | $ 404,820,596 | Machinery | 95.70 | 15.52 |

| Sientra | $ 7,294,204 | Health Care Equipment and Supplies | 94.72 | 12.12 |

| Beyond Meat | $ 574,414,063 | Food Products | 94.19 | 40.04 |

| PureCycle Technologies | $ 664,440,209 | Chemicals | 93.74 | 39.55 |

| Luminar Technologies | $ 1,383,611,763 | Automobile Components | 91.73 | 23.25 |

| Mondee Holdings | $ 230,105,166 | Hotels, Restaurants and Leisure | 90.36 | 17.77 |

| Vuzix Corporation | $ 132,038,062 | Electronic Equipment, Instruments and Components | 89.39 | 17.49 |

| Oddity Tech Ltd. | $ 2,643,251,439 | Personal Care Products | 89.26 | 18.74 |

Download the ORTEX App!

ORTEX is now available as an app! Users can download the brand new ORTEX app from the Apple store or Google Play store.