ORTEX Short Interest Insights from January

January saw the market rebound in the wake of 2022’s carnage, and ORTEX Short Interest Data showed most sectors seeing a decline in bearish bets last month as investors repositioned their portfolios for a new year. Short interest (SI) shares in the utilities sector fell the most, declining 10.6%, while industrials stocks saw a 4.1% jump in SI shares.

Here are ORTEX’s estimates for how aggregate short interest (SI) shares changed for each S&P 500 sector for the month of January.

| Sector | Starting SI Shares | Ending SI Shares | % Change |

| Energy | 436,540,506 | 400,765,303 | (8.2%) |

| Materials | 195,390,120 | 202,821,521 | 3.8% |

| Industrials | 469,587,049 | 488,857,318 | 4.1% |

| Consumer Discretionary | 869,212,797 | 826,007,627 | (5.0%) |

| Consumer Staples | 341,255,447 | 320,792,936 | (6.0%) |

| Health Care | 433,179,654 | 395,947,217 | (8.6%) |

| Financials | 540,602,432 | 540,925,792 | 0.1% |

| Information Technology | 897,170,970 | 861,158,330 | (4.0%) |

| Communication Services | 811,063,030 | 763,052,009 | (5.9%) |

| Utilities | 308,046,207 | 275,450,464 | (10.6%) |

| Real Estate | 284,826,505 | 267,878,998 | (6.0%) |

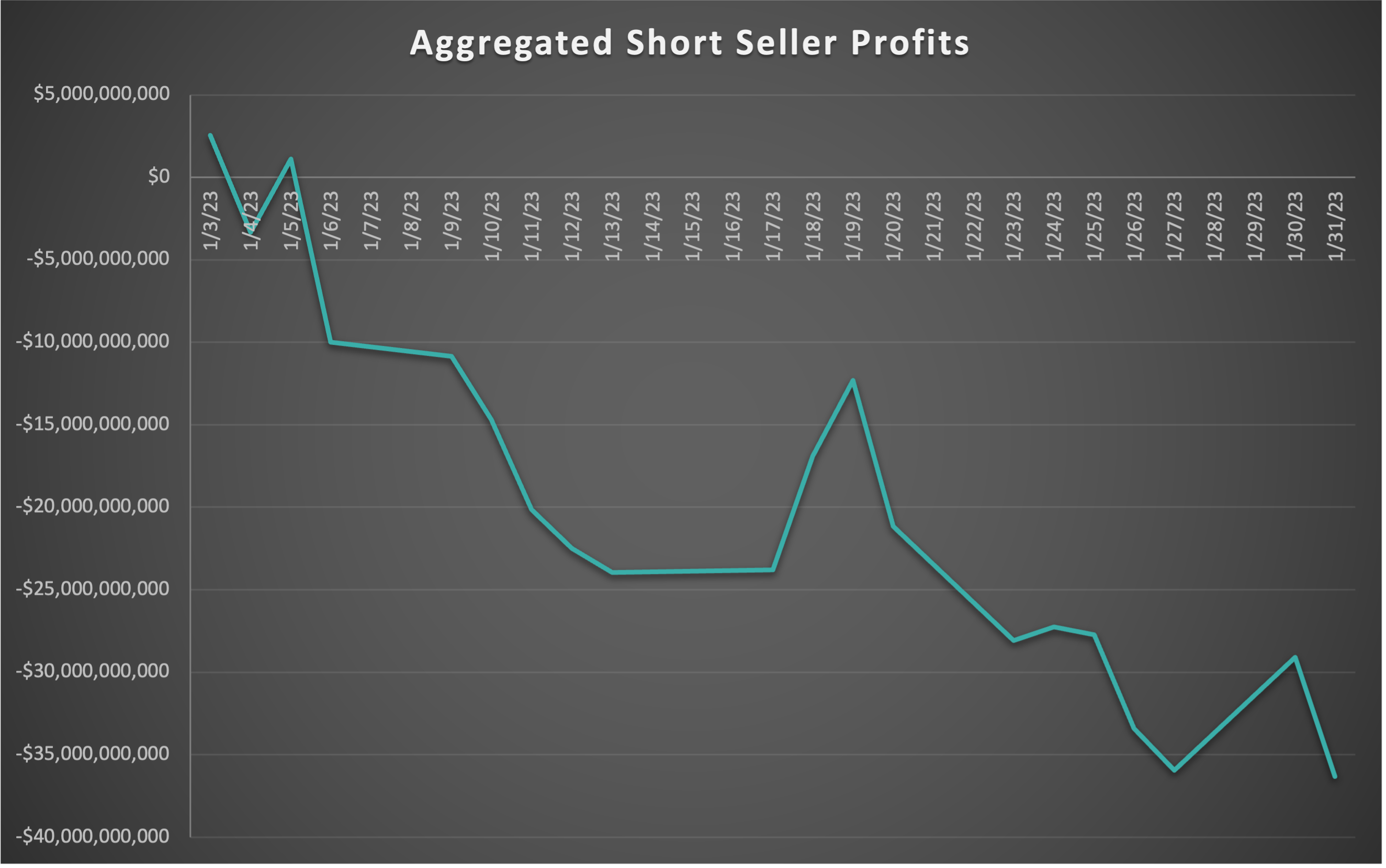

The strong performance of the major indexes last month led to heavy losses for short-sellers. In the aggregate, the bears lost $36.3 billion last month.

Top Short Seller Gain and Loss for January

After delivering billions in profits to short sellers in 2022, Tesla (Nasdaq: TSLA) stock enjoyed a massive rebound in January that led to heavy losses for the bears. Shares of the electric vehicle (EV) giant surged by 41% last month while short interest was simultaneously trending higher, resulting in $4.5 billion in losses for shorts. That was the biggest loss for short-sellers in January by a long shot.

The stock that generated the most profit for the bears last month was pharmaceutical juggernaut Pfizer (NYSE: PFE). Declining revenue from COVID-19 vaccines and treatments is hurting sentiment, and short-sellers reaped $353 million in gains from betting against Pfizer, the most profitable short trade in January.

Short Squeeze Candidates with the Highest ORTEX Short Scores

Pessimism among EV stocks continued to persist in January, as 4 pure-play EV stocks ranked among the highest ORTEX Short Scores on our platform (with at least 3 analysts covering the stock). Our ORTEX Short Score uses a multi-factor model that incorporates multiple short-related metrics, with a higher score indicating that the stock is heavily-shorted and has other characteristics that increase the possibility of a short squeeze occurring.

| Ticker | Stock | Market cap USD | Industry | Short Score | Estimated Short Interest % FF |

| EVGO | EVgo | $431,413,004 | Retailing | 98.11 | 39.29 |

| NKLA | Nikola Corporation | $1,420,415,793 | Capital Goods | 96.84 | 26.50 |

| CRCT | Cricut | $2,155,188,218 | Consumer Durables and Apparel | 96.73 | 23.73 |

| BYND | Beyond Meat | $1,048,561,048 | Food, Beverage and Tobacco | 96.52 | 37.44 |

| SDIG | Stronghold Digital Mining | $12,723,641 | Software and Services | 94.68 | 26.67 |

| BLNK | Blink Charging Co. | $676,504,034 | Capital Goods | 93.71 | 30.70 |

| FSR | Fisker Inc. | $2,208,326,099 | Automobiles and Components | 93.12 | 36.64 |

| PRME | Prime Medicine | $1,420,968,797 | Pharmaceuticals, Biotechnology and Life Sciences | 92.64 | 14.64 |

| IVC | Invacare Corporation | $25,486,651 | Health Care Equipment and Services | 92.41 | 27.17 |

| DNMR | Danimer Scientific | $233,193,947 | Materials | 92.27 | 19.43 |