ORTEX Short Interest Insights from December and 2022

The month of December started off with strong data for the labor market, with nonfarm payrolls soaring by 263,000 in November. Perhaps somewhat counterintuitively, the news sparked a brutal sell-off as investors worried that the data would allow the Fed to justify remaining aggressively hawkish.

Here are ORTEX’s estimates for how aggregate short interest (SI) shares changed for each S&P 500 sector for the month of December.

| Sector | Starting SI Shares | Ending SI Shares | % Change |

| Energy | 428,609,225 | 436,540,506 | 1.9% |

| Materials | 201,227,263 | 189,820,838 | (5.7%) |

| Industrials | 478,413,976 | 472,393,674 | (1.3%) |

| Consumer Discretionary | 887,020,080 | 869,212,797 | (2.0%) |

| Consumer Staples | 327,547,255 | 341,255,447 | 4.2% |

| Health Care | 442,158,310 | 433,179,654 | (2.0%) |

| Financials | 573,974,560 | 540,602,432 | (5.8%) |

| Information Technology | 872,955,954 | 892,494,326 | 2.2% |

| Communication Services | 779,881,430 | 811,063,030 | 4.0% |

| Utilities | 301,973,823 | 308,046,207 | 2.0% |

| Real Estate | 288,870,158 | 284,826,505 | (1.4%) |

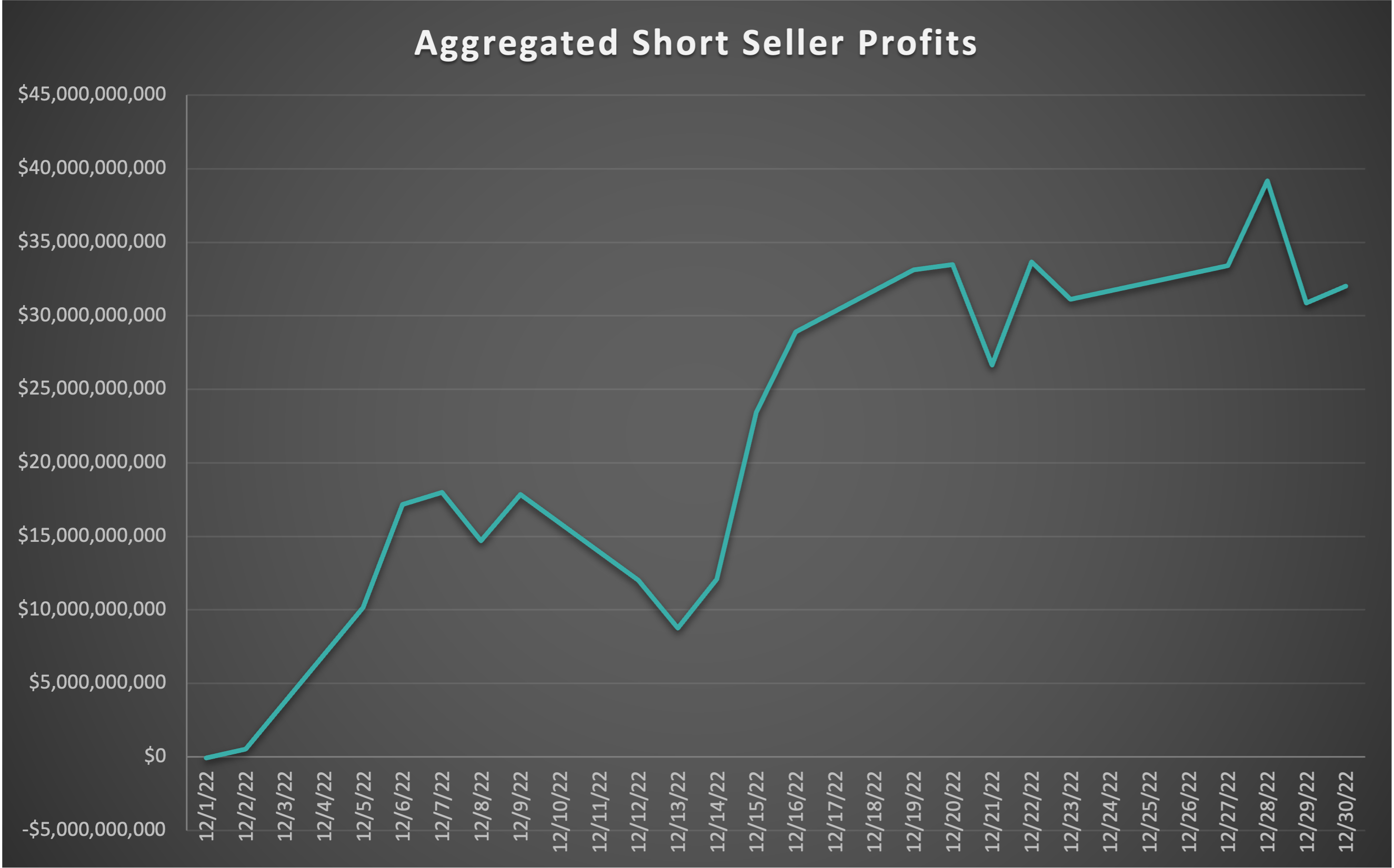

Heading into the month, the market was coming off a strong rally at the end of November driven by the Fed confirming that it would moderate upcoming interest rate hikes, but the specter of a potential recession on the horizon contributed to ongoing weakness. Short-sellers were able to reap $32 billion in cumulative profits for December.

Top Short Seller Gain and Loss for 2022

Due in part to Russia’s invasion of Ukraine and the subsequent spike in oil prices, energy stocks outperformed in 2022. That included a strong 80% rally for energy giant Exxon Mobil (NYSE: XOM). While short interest is low as a percentage of free float (less than 1%), Exxon Mobil’s sheer size led to short-seller losses of $1.71 billion for all of 2022.

For the third month in a row, Tesla (Nasdaq: TSLA) delivered more in profits to short sellers than any other stock. The EV giant’s shares continue to slide on demand fears and deteriorating investor sentiment, yielding $5.44 billion in short gains for the month of December. For the full year, Tesla bears reaped an incredible $15.75 billion in profits thanks to the stock’s 65% decline in 2022.

The rally in energy stocks led to short-seller losses across that sector, while the list of short-seller gains is dominated by technology companies and EV upstarts. Here are the top 10 short-seller gains and loss for all of 2022.

| Ticker | Company | Short Profit/(Loss) 2022 |

| TSLA | Tesla | $15,747,450,229 |

| AMZN | Amazon | $5,566,701,421 |

| AAPL | Apple | $5,377,089,510 |

| META | Meta Platforms | $5,358,172,761 |

| SQ | Block | $4,213,891,749 |

| MSFT | Microsoft | $3,928,595,127 |

| SE | Sea Limited | $3,677,222,692 |

| AMD | Advanced Micro Devices | $3,505,686,704 |

| NVDA | NVIDIA | $3,432,330,458 |

| LCID | Lucid Group | $3,350,254,721 |

| SLB | Schlumberger | ($532,841,498) |

| PCG | PG&E Corporation | ($554,972,780) |

| COP | ConocoPhilips | ($591,572,739) |

| MRK | Merck & Co. | ($609,783,960) |

| VLO | Valero | ($613,976,903) |

| MPC | Marathon Petroleum | ($818,831,725) |

| AMGN | Amgen | ($934,771,553) |

| OXY | Occidental Petroleum | ($1,089,402,411) |

| CVX | Chevron Corporation | ($1,171,415,134) |

| XOM | Exxon Mobil | ($1,708,713,548) |

Short Squeeze Candidates with the Highest ORTEX Short Scores

Looking ahead to a new trading year, bearish sentiment remains strong among EV stocks. Of the top 10 short squeeze candidates with the highest ORTEX Short Scores (with at least 3 analysts covering the stock), 4 are EV pure-play stocks. Our ORTEX Short Score uses a multi-factor model that incorporates multiple short-related metrics, with a higher score indicating that the stock is heavily-shorted and has other characteristics that increase the possibility of a short squeeze occurring.

| Ticker | Stock | Market cap USD | Industry | Short Score | Estimated Short Interest % FF |

| NKLA | Nikola Corporation | $1,107,616,647 | Capital Goods | 97.19 | 31.43 |

| BYND | Beyond Meat | $784,667,873 | Food, Beverage and Tobacco | 96.36 | 38.75 |

| SDIG | Stronghold Digital Mining | $11,083,448 | Software and Services | 96.33 | 26.33 |

| FSR | Fisker Inc. | $2,267,589,087 | Automobiles and Components | 95.41 | 34.30 |

| BLNK | Blink Charging Co. | $557,988,666 | Capital Goods | 94.10 | 32.28 |

| CRCT | Cricut | $2,046,987,170 | Consumer Durables and Apparel | 93.97 | 23.60 |

| EVGO | EVgo | $310,034,747 | Retailing | 93.71 | 34.23 |

| DNMR | Danimer Scientific | $181,485,724 | Materials | 92.79 | 21.77 |

| CSSE | Chicken Soup for the Soul Entertainment | $106,341,606 | Media and Entertainment | 92.68 | 11.61 |

| SMR | NuScale Power Corporation | $532,198,676 | Capital Goods | 92.17 | 17.72 |