An Introduction to ORTEX Short Interest data

Short Interest has recently been a topic of active discussion. At the centre of the discussion is GameStop (GME), but many other companies are affected by high levels of Short Interest. For example, AMC Entertainment Holdings, Inc. (AMC) and Blackberry (BB), are also two very interesting recent cases.

Short statistics and trends are a crucial element in understanding how a stock behaves and how sentiment surrounding a stock is developing. For example, there may be a stock that has vast amounts of short interest, where a positive surprise could create a “short squeeze”, as investors that are short scramble to buy back the borrowed shares. Understanding how many shares are on loan and may need to be covered is important. Equally, if there is a sudden dramatic increase in short interest, it may be valuable to understand why and what the story or reason is. Timely and accurate short interest information is notoriously difficult to collate due to the vast numbers of fragmented pools.

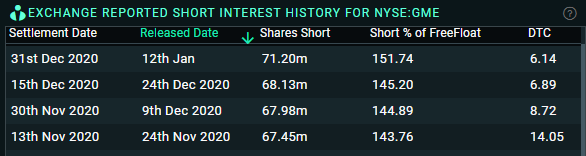

Exchange Reported Numbers

In the US, stock exchanges only publish short interest data twice a month and this data is also delayed by eight trading days, leaving investors in the dark regarding daily short selling activity. In addition, in Europe, financial institutions are only required to flag to the local regulator whenever they go over or back under certain thresholds. This provides valuable and timely additional data but only on positions above the reporting threshold. ORTEX add these flags intra-day as soon as the regulator publishes them, aggregates an institution’s overall current short position and lists all the latest flags so users get an accurate idea of latest sentiment.

Security Lending Data

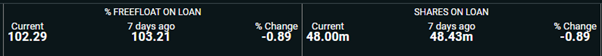

ORTEX Short interest data is sourced from the world’s largest combined pool (over 700k pools of liquidity) of Agent Lenders, Prime Brokers, and Broker-Dealers who submit their inventory. As the US exchange data is delayed (for reasons explained above) ORTEX fills this void with daily up‑to‑date information from the global securities finance market and enables users to gauge changes in investor sentiment. This data is updated by 7.30am EST each day with current stock borrows, meaning you won’t find more timely or accurate data. ORTEX looks at the number of shares being borrowed, because you need to borrow a stock in order to short it. In addition to seeing how many shares are out on loan (both as the actual numbers of shares, as a percentage of free-float and as a ratio of average volume (DTC)), this dataset also shows the average interest rate for current loans (Cost to Borrow) as well as the utilization. Utilization shows how many percent of the lendable shares are currently lent out.

Combining the data

Combining the exchange released data and the latest daily security lending change is useful because Exchange data (although delayed) is highly accurate and our security lending data also gives a very accurate sentiment change. So if you combine the previous exchange release, with the latest daily percentage change, you can usually predict what future exchange releases will be.

See an example below in purple, together with the Exchange reported number in blue and the Shares on loan in red.

To see all ORTEX Trading Signals – Including Short Squeeze Signals, as well as getting the latest Short Interest Data – Join now for free