ORTEX Monthly Recap for February

ORTEX Perspectives on the S&P 500 for February

February proved a difficult month for markets, and ORTEX Short Interest Data showed most sectors continuing to see a decline in bearish bets last month. Short interest (SI) shares in the utilities sector fell the most, declining 10.6%, while industrials stocks saw a 4.1% jump in SI shares.

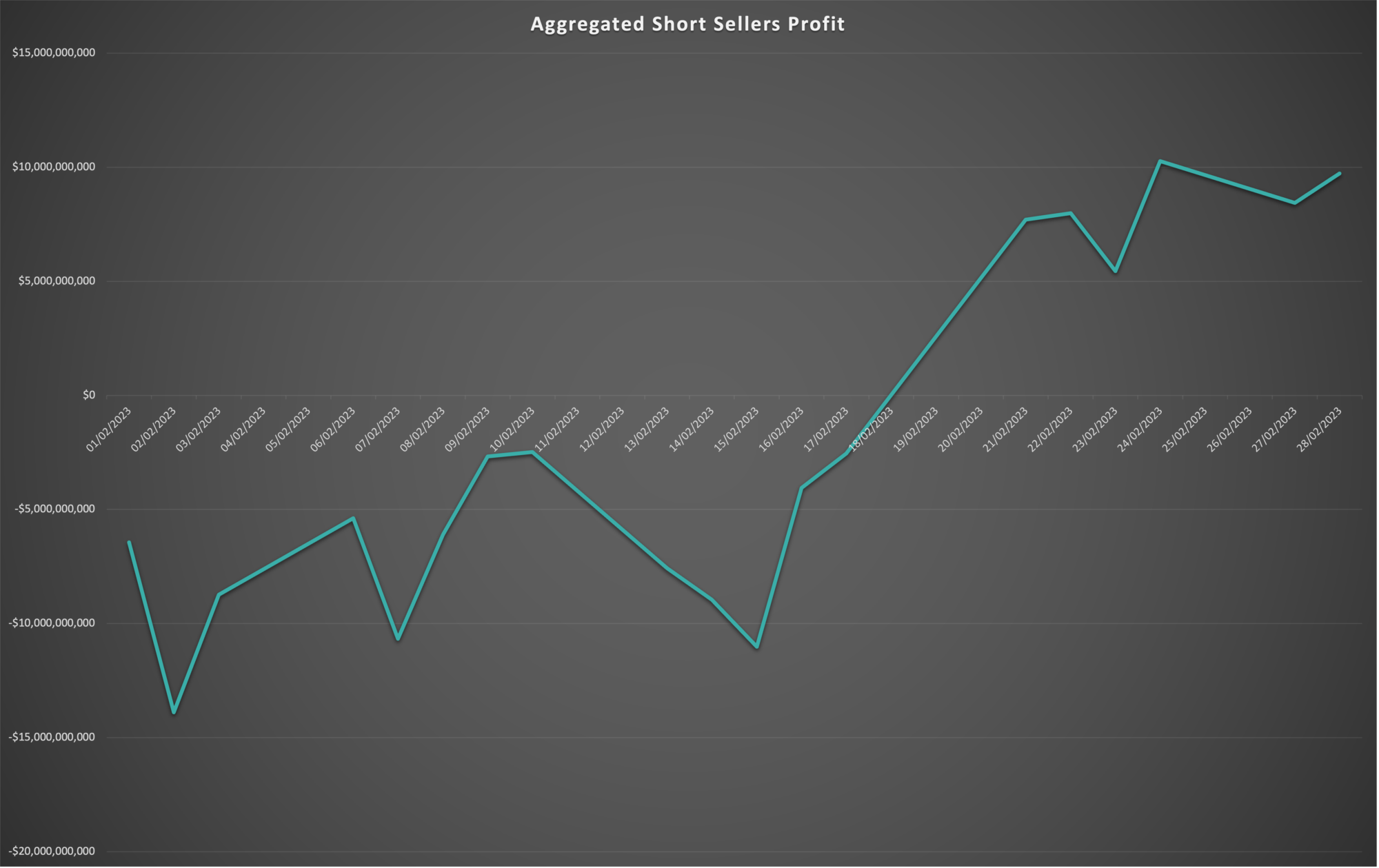

With all the major indexes struggling last month, short-sellers closed out the month with a decent profit. In the aggregate, the bears made $9.74 billion last month.

With earnings season now in full swing, there have been some significant changes in forward-looking earnings estimates from Wall Street. Real estate Financial stocks saw the largest increase in EPS estimates, up 10.4%, while profitability forecasts for the energy sector fared the worst, down 3.9%.

Insider buying activity was almost 100x greater in February than January, with $602.8 million in insider purchases last month, according to ORTEX Insiders Data. However, a large majority of this was exercise of options and thus ranked as low Trade Significance. Insider selling activity also rose in February, totaling $5.5 billion. That translates into an insider buying ratio of 9.9% across all levels of Trade Significance, which is drastically up from January’s 0.2%.

On the options front, positive order value for SPY was $8.42 billion, while negative order value for the fund was $5.53 billion. That positive order value ratio of 60.3% represents a reduction in sentiment among options traders, compared to January’s figure of 63%.

Market developments in February

US stocks faced their toughest week of 2023 in February, which proved a tough month for markets. Inflation data, including the core Personal Consumption Expenditures (PCE) Price index, the Fed’s preferred measurement of inflation, rose 0.6% in January and 4.7% from the prior year, coming in above economists’ expectations of a 0.4% gain for January and 4.3% annual rise. The report added to concerns that inflation “stickiness” will linger in a still-growing economy and force the Fed to keep rates higher for longer to quell inflationary pressures.

At its Jan 31-Feb 1 meeting, the FOMC raised the federal funds target rate by 25 basis points (0.25%), however, with this latest PCE report and minutes from the Fed stressing high concerns over inflation, markets are worried. Markets are now pricing in a rise in the benchmark federal-funds rate to between 5.5% – 5.75%, more than half a percentage point higher than where investors thought rates would peak at the start of February.

February has seen strong labor market data with the Bureau of Labor Statistics reporting that nonfarm payrolls jumped by 517,000 in January, nearly double December’s total and almost triple the consensus forecast of 185,000. The country’s unemployment rate ticked down to 3.4%, the lowest for 53 years, adding to inflationary pressures.

For February, the Dow Jones Industrial Average fell 4.2%, the S&P 500 decreased by 2.6%, while the tech-heavy Nasdaq Composite lost 1.1%.

February’s Top Performing Trading Signal

On February 2nd, ORTEX generated Type 2 and Type 3 Short Squeeze Trading Signals for Iveda Solutions (Nasdaq: IVDA) based on historical trading activity. A day earlier, Iveda announced $1 million in new smart city contracts with organizations and municipalities across Taiwan.

This news comes on the heels of Iveda’s $1.5M Utilus Smart Pole deployment in Taiwan, which was announced in January, providing a big boost to the company’s fundamentals as it continues to set the standard for smart city innovation worldwide. As a result, the signal was able to enjoy a return of 94.44% over the prior best holding period of 10 days, making it the best performing ORTEX Trade Signal in February.

Please note that ORTEX Trading Signals are based on historical performance and are not investment advice.

Highest Short Seller Gain and Loss for February

After delivering billions in profits to short sellers in 2022, Tesla (Nasdaq: TSLA) stock continued heaping the pain on short sellers in February. Since the beginning of the year, Tesla has surged 67%, with shares of the electric vehicle (EV) giant up by 19% in February. ORTEX data shows short interest reversing course in February as bears look to minimize their pain, resulting in $3 billion in losses for short sellers.

The stock that generated the most profit for the bears last month was Amazon (Nasdaq: AMZN). Between the tech sector’s tough 2022, a mixed fourth-quarter earnings report, disappointing news from rival companies and backlash from employees after Amazon’s return to office (RTO) mandate, Amazon stock has been declining since the beginning of the month. Short-sellers reaped $613 million in gains from betting against Amazon, the most profitable short trade in February.

Short Squeeze Candidates with the Highest ORTEX Short Scores

Pessimism among EV stocks has not fallen so far in 2023, as 3 pure-play EV stocks ranked among the highest ORTEX Short Scores on our platform (with at least 3 analysts covering the stock). Our ORTEX Short Score uses a multi-factor model that incorporates multiple short-related metrics, with a higher score indicating that the stock is heavily-shorted and has other characteristics that increase the possibility of a short squeeze occurring.

| Ticker | Stock | Market cap USD | Industry | Short Score | Estimated Short Interest % FF |

|---|---|---|---|---|---|

| EVGO | EVgo | 404362993 | Retailing | 98.017 | 37.9099 |

| CRCT | Cricut | 2254556527 | Consumer Durables and Apparel | 96.3739 | 23.8085 |

| QS | QuantumScape Corporation | 4172111820 | Automobiles and Components | 96.2757 | 21.2274 |

| TTCF | Tattooed Chef | 113775365 | Food, Beverage and Tobacco | 95.5464 | 33.1743 |

| NKLA | Nikola Corporation | 1230678751 | Capital Goods | 94.5608 | 27.976 |

| BYND | Beyond Meat | 1204052780 | Food, Beverage and Tobacco | 94.3343 | 39.1665 |

| SMR | NuScale Power Corporation | 536867085 | Capital Goods | 92.195 | 37.9928 |

| DNMR | Danimer Scientific | 261582776 | Materials | 91.4693 | 17.3088 |

| CGC | Canopy Growth Corporation | 1148380958 | Pharmaceuticals, Biotechnology and Life Sciences | 91.2468 | 16.1014 |

| FSR | Fisker Inc. | 2317494762 | Automobiles and Components | 90.9332 | 40.6231 |

What’s New on ORTEX

We continue to improve and update our Index Rebalance datasets, with February’s MSCI Quarterly Comprehensive Index Review (QCIR) and Russell updated with the latest changes. With almost $3 trillion tracking the MSCI, ORTEX predictions enable users to position themselves to take advantage of predicted changes. For the MSCI’s QCIR, ORTEX posted an 86% accuracy.